|

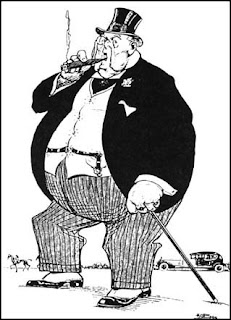

| The Subsidised Mineowner, 1925 Wikimedia Commons |

You may want to ponder over this announcement for a few moments: yes, this is the same Barroso who was President of the European Commission from 2004 to 2014, during which Europe experienced the worst financial crisis since the Great Depression largely caused by careless and fraudulent behavior by US investment banks, and Europe also faced the Greek debt crisis - Greece that became member of the Eurozone by masking its government debt thanks to Goldman Sachs.

This is also the same Barroso who in 2005 had spent a week on the yacht of the Greek shipping billionaire Spiro Latsis, a month before the Commission approved Greek state aid of ten million euros for Latsis's shipping company. It was then that Nigel Farrage, Member of the European Parliament for the British UK Independence Party, filed a motion of no confidence in Barroso, which in the end did not receive majority support.

And this is also the same Barroso, who as Prime Minister of Portugal, and member of the Portuguese right-wing Social Democratic Party, hosted a meeting in the Azores in 2003 with US President George W. Bush, and the Spanish and British Prime Ministers José María Aznar and Tony Blair, where these four leaders agreed to the infamous US-led invasion of Iraq, a decision which turned out to be one of the most devastating and misguided wars in modern history.

Oh, and did I mention that Barroso as a student was one of the leaders of

the underground Maoist MRPP party. Although this could be due to youthful transgression, clearly Barroso has shown a canny skill in reaching the top no matter the consequences for others. And now he is joining Goldman Sachs.

This is the same Goldman Sachs that participated in and benefited from the US mortgage crisis in 2008, by betting against toxic mortgages they themselves had created and by benefiting from the AIG government bailout to the tune of $12.9 billion - of which $2.9 billion profit for Goldman, mind you a profit which if free market principles had applied would have been a huge loss for the firm, - a deal by the way arranged by then-Treasury Secretary Henry Paulson, former head of Goldman Sachs.

This is also the same Goldman Sachs that benefited in 2008 from a $125 billion bailout - shared with eight of the other US largest banks. Although Goldman's financial life was at risk, with US government's help it managed to report in 2009 and 2010 nearly $22 billion in profits, and more importantly paid out $31.6 billion in compensation to its employees (i.e. approximately an average of $430,000 each.)

And this is also the same Goldman Sachs that arranged to hide the actual amount of Greece's government debt, ensuring that Greece would fulfill the criteria of the Maastricht Treaty and that Greece could join the euro in 2001. In the meanwhile, Goldman reportedly made Euro 600 million with these transactions, and Greece's debt, as part of this transaction, has since doubled. Now over a decade later the Greek crisis has still not been resolved and the livelihood of the Greek population has worsened. For an excellent overview of Goldman's role in Greece, see below TV documentary from the Dutch broadcaster VPRO (this documentary is predominantly in English, for the parts that are not activate the Youtube subtitle-function; see also at 29:30 the discussion of Goldman Sachs in government positions.)

Goldman Sachs and the Destruction of Greece/Backlight

Oh, and did I mention that Goldman settled with the US Department of Justice in January 2016 (!) to pay $5.06 billion for its role in the 2008 financial crisis. Acting associate attorney general Stuart Delery said in a statement:

"This resolution holds Goldman Sachs accountable for its serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail."

So, I assume Mr. Barroso, with a yearly EU pension of Euro 125,000, had a wide range of positions to choose from. He could have chosen to join a not-for-profit organization, let's say helping the quality of ocean water and fisheries which could benefit Portuguese fishermen; he could have chosen to join a board of a reputable bank supporting small businesses. Those choices were probably too much to expect from a former senior EU executive. He decided to choose for big money and against regular people's interests by joining a highly efficient, amoral moneymaking machine, that has shown at best to be ethically challenged and at worst responsible for illegal transactions, with devastating consequences for EU citizens in Greece and beyond. However, let's not fault Mr. Barroso too much as he is in good company: previous EU commissioners Mario Monti and Karel van Miert have been advisors to Goldman Sachs, as well as current President of the European Central Bank, Mario Draghi and former German central banker at the ECB, Otmar Issing. Whether joining Goldman Sachs is just deserts, or "just" crony capitalism, it is another nail in the coffin of the EU as we know it.

No comments:

Post a Comment