|

| Hamburgers by uberculture/Flickr |

In the same week that I heard about some really

unappetizing food at McDonalds, The Economist came out with its latest analysis

of foreign-exchange rates according to its popular Big Mac index. This is how

The Economist explains its index:

"Its secret sauce is the theory of

purchasing-power parity (PPP), according to which prices and exchange rates

should adjust over the long run, so that identical baskets of tradable goods

cost the same across countries. Our basket contains only a Big Mac, and relies

on the efforts of McDonald’s to produce identical products from the same

ingredients everywhere - underlining

added - (or almost everywhere: for India we use the Maharaja Mac, which

contains chicken rather than beef) "

So by and large, the Big Mac Index is based on

comparing the price of an identical product (i.e. the Big Mac) around the

world, the Index can determine whether a local currency is over - or

undervalued against the dollar. The Economist continues:

"... At market exchange rates, the Canadian

version of the burger costs $5.39, compared with an average price of $4.37 in

America. By our reckoning, then, the Canadian dollar is roughly 24% overvalued

relative to its American counterpart...."

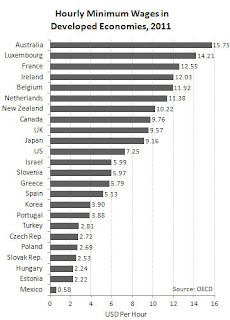

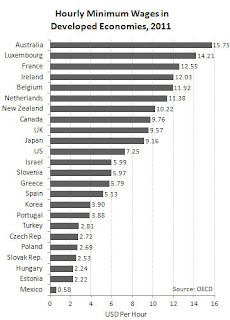

Generally, average prices of hamburgers are lower

in poor countries due to their lower labor costs, and this would invalidate

some of the Index' conclusions, claim critics of the Big Mac Index. But I pose

there is another criticism based on the "identical product"

assumption.

.jpg)

.jpg)